THE FUTURE OF RETAIL PART 3: Rental x Retail: The Untapped Growth Loop Hiding in Plain Sight

Rental isn’t a side business.

It’s the most underleveraged retail engine in outdoor.

For decades, ski and snowboard rental models have shared the same problems:

• Costs escalate after a couple of days

• Lines eat the first hour of your ski day

• The gear is “close enough,” but rarely what you want

But here’s what most operators miss:

Rental customers are actually your highest-intent buyers.

They try, they ask questions, they come back multiple times — and they spend more on accessories than gear owners.

Outdoor is finally evolving because friction is finally being removed.

And the best signal of where the category is going comes from outside the industry:

1) Zipcar proved convenience wins… until it’s easy to copy.

2) Silvercar proved premium wins… until you forget to build a path into ownership.

3) The legacy fleets digitized the transaction — but never the relationship.

Outdoor has a chance to solve all three of these failures at once.

Which is why I think Vail Resorts Epic Gear is one of the most strategically interesting moves in mountain retail.

It removes the worst frictions of traditional rental — and opens the door to something much bigger:

A seamless rent → ride → buy pathway.

Imagine:

• Rental spend applied to gear ownership

• Accessories and apparel driven by a high-intent audience

• Data-informed recommendations based on actual use

• A progression model that grows with families for years

Epic Gear isn’t just a rental upgrade.

It’s the foundation for a vertically integrated retail flywheel — one that car rental companies never figured out, and one that the outdoor industry is perfectly positioned to own.

In a category where trust, confidence, and reduced friction win the day…

The future of retail will belong to the operators who design rental as part of the entire journey — not the prelude to it.

There’s a paradox in outdoor retail that we rarely talk about.

Rental is one of the most powerful acquisition engines available… and yet most operators treat it like an operational burden rather than a strategic advantage.

Ski shops, snowboard shops, bike shops — they’ve all run rental programs for decades. Consumers love the lower upfront cost. They tolerate the compromises. And they grit their teeth through the line on a powder morning when they’d give anything to skip the circus and get on the mountain.

But underneath all that friction is an extraordinary truth:

When designed intentionally, rental isn’t a service. Rental is the beginning of a long-term retail relationship.

And the outdoor operators who understand this are going to shape the next era of growth.

What Rental Behavior Really Tells Us

When a customer rents skis, a snowboard, or a high-end mountain bike, they’re not signaling low value. They’re signaling high intent.

They’re saying:

“I want to try before I commit.”

“I’m willing to pay for the right guidance.”

“I’m not confident enough yet to buy.”

This is gold.

Rental customers come back multiple times. They ask questions. They browse. They spend more on accessories because they didn’t just drop $1,000 on gear. In many outdoor shops, rental-day accessory sales represent 20–40% of total revenue.

And the biggest unlock? Once renters know what “good” feels like, they convert — and they convert fast.

The problem is that most rental programs stop at the moment of return. They don’t build a bridge to what comes next.

The Three Frictions Holding Traditional Rental Back

Outdoor rental has always carried the same pain points:

1. Cost curves that don’t make sense

A couple of days of renting skis or a bike can eclipse the cost of ownership — making rental feel like a sunk cost rather than a trial.

2. Massive time friction

Rental shops on peak mornings are exercises in controlled chaos. Nobody enjoys the experience — not the guests, not the front-line staff, and certainly not the operators watching conversion opportunities walk out the door.

3. Gear that never feels exactly right

You compromise on the model, the fit, or the performance. You get “close enough,” but not your gear.

These frictions don’t kill rental — but they do kill the rental → retail progression.

The New Outdoor Rental Models Fixing These Issues

Across outdoor categories — bikes, skis, snowboards — we’re seeing new models that address the pain head-on:

1. Lower, clearer, more strategic pricing

Tiered performance levels. Multi-day bundles. Applying rental or demo spend toward a purchase. These shift rental from “cost center” to “confidence builder.”

2. Tech-enabled speed and convenience

Mobile fittings, hotel delivery, express pickup, pre-sized reservations. When you eliminate the worst part of the process, you transform the entire perception of the brand.

3. True rent-to-own pathways

This is the breakthrough the industry has been waiting for. If people know their rental dollars build toward ownership, every day on the mountain becomes a test ride — not a transaction.

Outdoor operators are finally beginning to recognize that rental isn’t the end of the journey; it’s the beginning.

What the Car Rental Industry Already Learned the Hard Way

If outdoor operators want a glimpse of where rental models can go — and where they can fail — the car rental industry has already written the playbook.

Zipcar: Convenience without a moat

Zipcar’s entire value proposition was simple: “wheels when you want them.” No counters, no paperwork, no headaches. They proved that removing friction drives adoption.

But convenience is easy to copy. It only takes once for my neighborhood car to not be available for me to not consider Zipcar. And without an ecosystem or progression path, Zipcar became a feature — not a flywheel.

Silvercar: Premium without progression

Silvercar got the experience right. Every car was an Audi. No surprises. No upsells. But even with rabid fans, the model stalled.

Why? There was no move from renting an Audi to owning one. The ecosystem stopped at the return lane.

The Legacy Fleets: Digitized but not personalized

Hertz, Avis, Enterprise modernized their operations. Apps, faster checkouts, loyalty programs.

But they never built customer progression. They offered efficiency, not relationship.

Outdoor Can Avoid These Mistakes — And Build Something Better

Unlike car rentals, outdoor retailers and resorts have a natural, high-emotion pathway from trial → trust → ownership.

Skiing, riding, biking — these are identity sports. Once someone finds gear that fits, performs, and aligns with how they see themselves on the mountain, they want to own it.

Outdoor brands have an advantage car rental never had:

They can turn rental into confidence. And confidence into retail.

Which Brings Us to Vail Resorts — And the Real Potential of Epic Gear

Epic Gear is one of the first big moves in the industry that acknowledges this shift.

It removes the worst frictions:

No rental-shop chaos

Predictable, high-quality gear

Pickup across resorts

A consistent experience season to season

But more importantly, it opens the door to something bigger: a full rental → retail flywheel built inside the world’s most powerful mountain ecosystem.

Imagine the possibilities:

1. Rent → ride → buy

Guests can apply portions of their subscription or rental spend toward ownership — without leaving the Vail ecosystem.

2. Retail attachment on steroids

Rental users spend more on accessories, layers, helmets, and goggles than gear owners. Epic Gear can become the anchor for a reimagined retail mix.

3. Data-driven personalization

Boot flex, ski width, stance angle, ability progression, terrain preferences — these aren’t just specs. They’re retail signals. In a sport like Skiing where personalization is key to performance and enjoyment, the fact that Epic Gear records all of my stats makes it easy to personalize the equipment I'm renting.

Epic Gear could eventually recommend the exact gear someone should buy and make it feel like a natural next step, not a hard sell.

4. Building lifelong loyalty through progression

Kids who start in seasonal or subscription rentals become families who trust the brand with bigger-ticket purchases for decades.

This is the opportunity: Turn the world’s most frustrating experience (traditional rental) into the most powerful growth engine in mountain retail.

The Real Takeaway

Most retailers chase traffic. Rental gives you traffic for free — if you design it with intention.

If you solve the three frictions (cost, time, compromise) and build a path to purchase, rental stops being a cost center.

It becomes:

A trust engine

A confidence engine

A progression engine

A retail engine

Rental isn’t the warm-up act.

Rental is retail’s future — especially for operators with platforms as large as Vail Resorts.

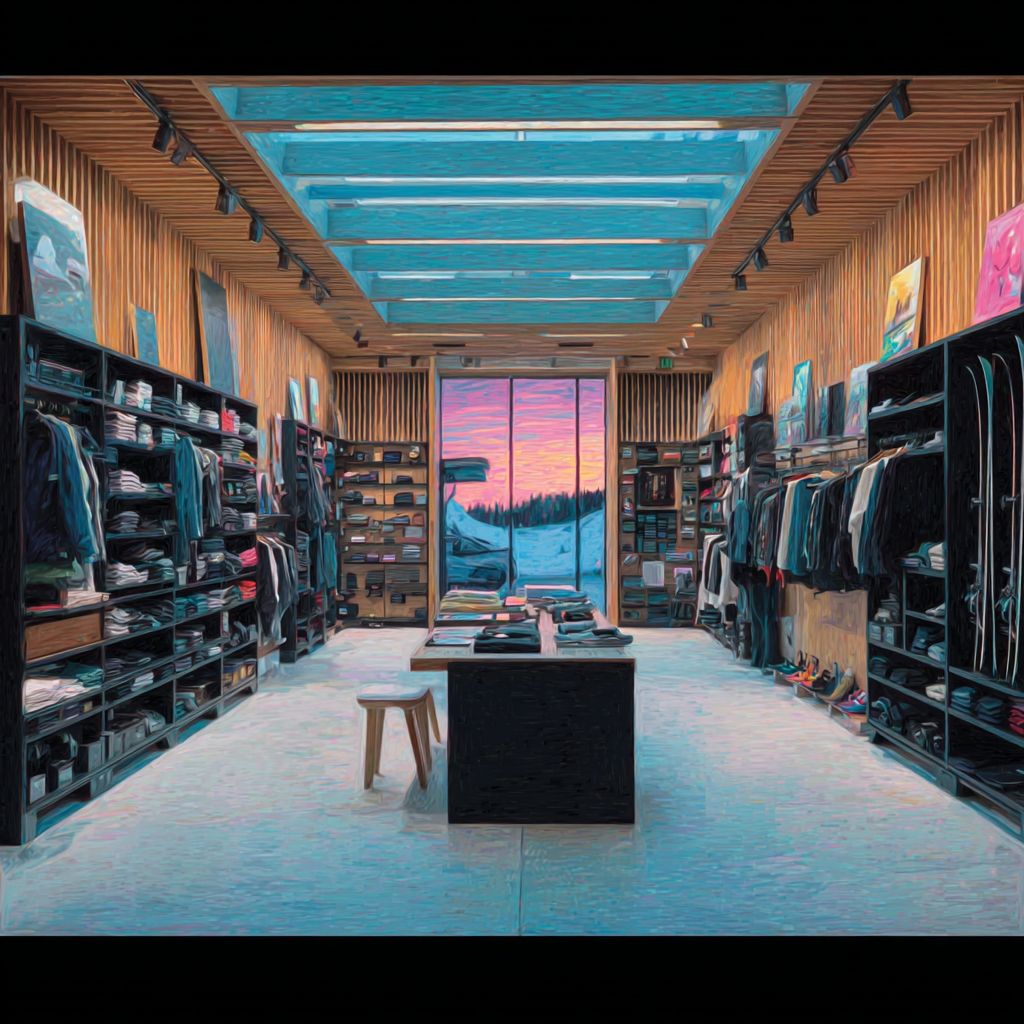

THE FUTURE OF RETAIL PART 2: Why Curated Retail Wins Where E-Commerce Can’t

Most retailers miss the real question:

If I can buy your merch online…

why would I ever buy it in-store?

And the inverse:

If I can only buy it in-store… why bother listing it online at all?

That tension is where strategy usually breaks.

I learned this the hard way at Planet 13.

Inside the superstore, apparel wasn’t “merch.”

It was awareness media — a memory you could wear through TSA, campuses, and cities across the country.

A hoodie wasn’t a hoodie.

It was a stamp: I was there.

But the moment we sold the same apparel online, the model wobbled.

Because the real question surfaced:

Why would I buy a Planet 13 hoodie online — especially after I already visited?

And then the kicker:

If I can buy it online… why buy it in the store?

That’s where the unlock comes in:

Separate what’s scarce from what’s shareable.

In-store = exclusivity

• Collabs, LTOs, geo-locked drops

• Premium fabrics

• Cultural capital (“you had to be there”)

• The item you brag about because you earned it

Online = memory

• Evergreen designs

• The pieces you “rep” at home

• The digital extension of the experience — not the replacement

In-store signals identity.

Online signals affinity.

Two different jobs. Two different emotions. Two different levers.

And nowhere is this more obvious than in vacation retail.

On vacation, willingness to spend spikes — not because people need a hoodie, but because they want an artifact.

Not a souvenir… a proof of presence.

That’s why the $180 Vail hoodie sells.

Not because it’s warm — but because it carries the moment.

The retailers who get this build a flywheel:

Experience → Purchase → Memory → Brand Signal → Return Trip

The ones who don’t?

They accidentally commoditize the very thing they could be premiumizing.

If you’re in experiential retail, hospitality, cannabis, or destination travel, this is the strategic litmus test:

Does your in-store merch create cultural capital?

Does your online merch preserve the memory?

Or are they cannibalizing each other?

Design for both — intentionally — and you unlock a growth engine most brands never tap.

There’s a tension most retailers gloss over:

If consumers can buy your merchandise online, why would they ever buy it in-store? And the inverse is just as important: If they can only buy it in-store, why bother offering it online at all?

This is where the difference between purchasing and remembering becomes strategic.

I first understood this at Planet 13.

The Planet 13 Lesson: Apparel Isn’t Merch — It’s a Memory Vehicle

Inside Planet 13, apparel wasn’t treated as a category. It was treated as awareness media.

The belief: Visitors would buy a hoodie, fly home, and suddenly the brand was walking through airports, campuses, and cities all over the country.

It worked for Hard Rock Cafes in the ’80s. A t-shirt wasn’t a t-shirt — it was shorthand for “I was there. I lived that moment. I’m part of the culture.”

But then Planet 13 started to sell apparel online.

And that’s where the strategy wobbled.

Because the real question emerged:

Why would I buy a Planet 13 sweatshirt online - especially if I already visited the superstore?

The only compelling answer was: to remember a great visit to Las Vegas and the Planet 13 superstore experience AND to rep the brand and cannabis lifestyle (if you know, you know!)

But then we hit the second strategic question:

If I can buy the same hoodie online…why buy it in the store?

Which leads to the unlock.

The Unlock: Separate What’s Scarce From What’s Shareable

In-store → unique, collab, LTO pieces

Scarcity

Geographical uniqueness

“If you know, you know” cultural capital

Premium fabrics, elevated workmanship

You must visit to get it — that’s the point

Online → evergreen reminders of the experience

The things you “rep” at home

More universal designs

The digital extension of the physical memory, not a substitute for it

See content credentials

In other words:

In-store merch signals identity. Online merch signals affinity.

Two different jobs. Two different emotional triggers. Two different business levers.

What This Means for Experiential Retail (when you're on vacation)

Sure — you can buy a generic Vail sweatshirt online.

But that’s not why people go to Vail. And it’s definitely not why they walk into Vail-branded retail.

Vacation unlocks two powerful psychological effects:

1. Elevated willingness to spend

When people are having a once-a-year experience, they buy differently. A $180 hoodie at home feels indulgent. On vacation, it feels like a memory worth keeping.

2. Desire for artifacts of the experience

Not souvenirs. Artifacts. Items that prove they were there — and capture how it felt.

This is where curated, premium, location-exclusive merchandise wins. Think:

Artist collaborations from local mountain creatives

Limited-run designs tied to snowfalls, opening day, or iconic runs

Premium-grade apparel you only get at that specific mountain

“Official” Vail gear that telegraphs belonging to the culture

This model does two things simultaneously:

1. It protects the in-person retail trip. You can’t replace the experience — or the exclusivity — online.

2. It gives online merch a clearer role. Not competition with the store, but continuation of the memory.

This Is the Blueprint for Modern Resort Retail

In-store = scarcity + story + sensory experience (“I bought this because I was there.”)

Online = memory + identity + accessibility (“I wore this because I remember what it felt like to be there.”)

When retailers collapse these two roles, they commoditize the very thing they could be premiumizing.

But when they design intentionally for both, they unlock a flywheel:

Experience → Purchase → Memory → Brand Signal → Return Trip

That’s the untapped value of vacation retail and merchandise.

The Future of Retail Part 1: Why We Still Need Stores in a World That Delivers Everything

Retail isn’t dying. Bad retail is dying.

In a world where you can buy anything from your couch, the real question is:

why do we still walk into stores at all?

Because e-commerce won convenience — but it killed the hunt.

Physical retail taps something older and deeper in us:

Discovery. Identity. Story. The dopamine hit of finding the thing you didn’t know you needed.

We’re entering a two-tier retail world:

1️⃣ Transactional retail → automate it, ship it, don’t think about it

2️⃣ Experiential retail → where expertise, emotion, and in-person discovery actually matter

(skis, bikes, outerwear, the categories where you feel the product before you buy it)

The future belongs to retailers who know the difference.

If you’re thinking about the future of retail, experience, and mountain culture…this series is for you.

Why We Still Need Stores in a World That Delivers Everything

The holiday season is when my discretionary spending goes vertical. Gifts, gear, last-minute “that would be perfect for her” purchases — I’m reminded how messy and unpredictable real purchase journeys still are. One minute I’m watching a swim meet, the next I’m ordering a coffee mug for my daughter because something — a line, an image, a feeling — pushed me from interest to buy.

And that brings me to the real question:

In a world where you can get anything online, why do we still need brick and mortar?

Why do I still walk into a ski shop? Why do grocery aisles still pull us in? Why does physical retail still matter?

The answer requires going backward before we look forward.

Retail Started as Trade — and Trade Started as Hunting

Brick-and-mortar retail isn’t a business model. It’s a human instinct.

Trade — both selling and buying — has been the engine of prosperous societies from the beginning. And shopping, in its modern form, still taps into something primal: our drive to hunt, to discover, to feel the dopamine hit of finding something that makes us — or someone we love — happy.

I grew up in Wisconsin in the ’70s where my mom treated the grocery store like a treasure hunt. We walked every aisle. Not because she needed to — but because she loved the discovery. That early exposure shaped my entire career in CPG and retail. Even now, I can still feel the spark of a great find.

E-Commerce Won Speed. But It Lost the Hunt.

Fast-forward to today. E-commerce has achieved its purest form: search → click → buy → done.

In that model, everything works — except the part that matters.

There’s no discovery. No narrative. No personalization. No role for emotion.

Amazon saw this gap and tried to close it with their “5-Star Stores.” Convenient? Absolutely. But they simply transplanted the transaction into physical space. No salespeople. No curation. No story. And no reason to come back.

It didn’t work because transaction alone doesn’t justify a trip. Experience does.

We’re Entering a Two-Tier Retail World

What’s emerging now is clearer every season:

1. Transactional Retail (E-commerce + Subscription + Low-Engagement Purchases)

Automate it. Outsource it. Don’t overthink it. Winter beanies, driving gloves, paper towels — all belong here.

2. Experiential Retail (High-Engagement, High-Emotion Purchases)

These are the categories where the hunt matters:

Buying skis

Choosing a bike

Upgrading outerwear

Selecting gear that expresses who you are and how you move through the world

I may visit my favorite ski shop multiple times before I buy. I’m flexing skis, talking to techs, imagining next season. I’m not just purchasing — I’m evaluating, learning, and confirming the story I want to tell on the mountain.

You simply can’t replicate that with a “Customers also bought…” carousel.

As Life Gets More Complex, Retail Splits Even Further

Technology is automating our low-lift decisions. But our human wiring still craves surprise, story, and connection.

We want friction removed where it slows us down. But we want friction preserved where it creates meaning.

The trick for retailers is understanding which trip your customer is on.

So What Should Retailers Do?

1. Know the “why” behind the trip. Is the customer here to transact…or to discover?

2. Remove friction for transactional missions. Don’t force “experience” when someone just wants to get in and out.

3. Deepen experience for high-engagement missions. Expertise. Storytelling. Trials. Sensory cues. Human connection.

4. Treat stores as stages, not stockrooms. A good store doesn’t just sell product — it changes how customers feel about themselves.

Closing Thought

Physical retail isn’t dying. Bad retail is dying.

What survives — and thrives — are the places that honor our need for discovery, identity, and human interaction.

In a Low-Trust World, Trust Becomes a Strategic Advantage

Why do we operate in a world where we don’t trust each other — or the institutions we rely on — and what does that mean for our brands, our economy and our innovation?

I believe trust is the hidden foundation of a successful society and thriving economy. When we trust: people transact, collaborate, institutions work, markets move. When we don’t: friction increases, adoption slows, innovation stalls.

Here’s a quick framework on how we got here + what it means + what to do about it.

1) What is trust — and how is it eroding?

✅ Interpersonal trust (e.g., “most people can be trusted”) in the U.S. is down to ~34% — vastly lower than earlier decades.

✅ Institutional trust (in government, media, science) has likewise slipped, reducing faith in systems built for us.

✅ Technological trust (in AI, platforms, digital systems) is under strain as authenticity, transparency and fairness are questioned.

2) Three accelerants of the low-trust environment:

✅ Social media & the flattening of authority — where a post from a peer can feel as credible as a major news outlet, expertise is de-valued, and disinformation spreads.

✅ COVID-19 & shifting expert/institutional signals — the pandemic exposed inconsistencies, politicised science and undermined the “trusted institution” default.

✅ Generative AI & authenticity risk — fraudulent images, videos and documents are now easier to produce; people ask “can I trust what I see or hear?”

3) The business/innovation cost of low trust:

✅ More friction in transactions.

✅ Slower adoption of new tech or products.

✅ Higher cost of proof, authenticity, verification.

✅ Brands that fail to signal trust pay a premium in effo rt and risk.

4. How to rebuild trust (your brand, your organisation, your tech):

✅ Be transparent: Show how things are built, how decisions are made, how AI/data work behind what you do.

✅ Be human & authentic: Real stories, real people, real oversight. People trust people more than logos.

✅ Embed trust in tech: If you use AI or digital systems — disclose use, provide explanation, give control, audit for fairness.

✅ Align with purpose: In a low-trust era, brands that stand for something beyond profit can earn trust premium.

✅ Play the long game (“little wins, big change”): Trust isn’t rebuilt overnight. Small consistent actions matter.

My ask of you:

What is one action you will take today to build trust with your audience, your customers or your team? Share it — accountability helps.

I think I'm reaching AI saturation in my news feed. Just a few recent headlines and anecdotes from friends which would be earth shattering 10 years ago, but today are just a blip

Wal-Mart strikes a deal with Open AI to incorporate AI search into their ecommerce

Amazon fighting with Perplexity, demanding it stop allowing its Comet web browser to make purchases on users behalf

Uber partners with OpenAI to integrate with ChatGPT - using AI to explore ride options and food deliveries

Children using AI chatbots discussing suicidal thoughts triggers Character.AI to ban children from under 18 from talking to its chatbots

Add to those headlines the information that the big AI companies need data centers which consume massive amounts of electricity - so much so that it's driving up energy prices across the country.

As a consumer it is dizzying following all of the news, understanding just the surface level of implications to all of these moves. So, is AI good or bad for ME? It can do research for me in an instant or make that cool meme, but my electricity bill is going up? I love chatting with my favorite company's customer service chat instead to talking to live person - but who was it REALLY on the other end of that keyboard?

From the formation of our society, trust is foundational for a healthy society and economy: it underpins cooperation, functioning markets, public-policy effectiveness, civic engagement and social cohesion. In the groundbreaking book "Why Nations Fail" the authors make the case that strong institutions with a foundation of rule of law creates trust that allows for broad sections of the population to participate in a successful economy.

Trust

If you think about it for a moment. If you couldn't trust your next door neighbor, you would over invest in things like security and you definitely would not ask to borrow a cup of sugar

If you couldn't trust companies like Amazon, there would be no way you would give them your credit card information and ecommerce would be dead.

If you couldn't trust Chase Bank, you would keep your money under lock and key, severely depressing economic activity

Trust is the bedrock to a successful American society.

So what do I mean by trust and how is it eroding? First, we must distinguish between three different kinds of trust:

Interpersonal trust — the belief that “most people can be trusted.”

Institutional trust — confidence in key institutions (government, media, science, business).

Technological trust — faith that platforms, algorithms and systems behave fairly, transparently and safely.

Trust has both an emotional dimension (belief, goodwill) and a functional dimension (competence, reliability, integrity). When these erode — when people feel institutions or systems are unpredictable, biased, opaque or ideological — trust falls. We have seen evidence that erosion in all three forms of trust has been happening for some time. Just a few stats:

In the U.S., the share of adults who say “most people can be trusted” declined from 46% in 1972 to about 34% in 2018, and remains at 34% in 2023-24. Pew Research Center

Trust in institutions: In spring 2024, only ~22% of U.S. adults said they trust the federal government to do the right thing “always” or “most of the time”, down from already‐low levels. pew.org

On a global level, the 2024 global trust index (via the Edelman Trust Institute) hit a 23-year low, with governments/trust in government at ~50%, businesses ~59%, NGOs ~54%. Medium+1

Institutional trust specifically in the U.S.: A May 2025 survey found only ~31% of U.S. adults have “a lot” or “some” trust in the federal government to act in society’s best interest

Why does this erosion matter? When trust is low, collective action is harder, institutions struggle to implement policy, markets may falter, innovation can lose its social license, and society becomes more fragmented. For example, communities working with government data/collections find greater success only when trust is present.

So how did we get here? I can point to two key areas recently:

Social media & information disorder

During the rise, and at the core of social media platforms is a trusted user network. Facebook and other social media platforms started by leveraging "interpersonal trust". I would see a post from my sister about her new baby and I inherently trust the information I'm reading. However, as social media evolved, it enabled a flattening of authority as news exchange started to creep in: that post from my sister when she talks about controversial subjects like vaccines now seems as credible as a major news outlet, lowering the “trust premium” of expertise.

Now add in the significant increase in disinformation campaigns by the platforms that are not moderating for truth and you have the erosion of trust in online content. In a survey, it was found that Americans believe only ~41% of what they read online is accurate & human-generated; 23% believe content is completely false; 78% say it’s increasingly difficult to distinguish real vs. AI-generated content. New York Post. The consequence is that if people can’t trust what they read, then the underpinning of informed decision-making, civic discourse and institutional legitimacy begins to crumble.

COVID-19, vaccines & expert/institutional status

When COVID-19 arrived, the ground was primed for an acceleration of conflicting messaging, changing guidance, politicisation of science and vaccines, all of which chipped away at the credibility of experts and institutions. As trust in institutions declined, people substituted peer networks, social media, or alternative sources for information – further diluting shared factual basis and collective trust.

Now enter additional technology shifts – especially generative AI – which are creating new risks to trust even as they are requiring MORE trust if they are truly going to live up to their promise. Fraudulent images, videos and documents can be produced rapidly, making authenticity harder to gauge. Globally, 66% of people use AI regularly; 83% believe it will bring benefits; yet only 46% are willing to trust AI systems. KPMG

Why the erosion of trust is becoming an issue

If consumers are stating that they can’t trust the output of AI (or, frankly they can't tell the difference between output that is real vs fake), then how will they ever jump to the point of agentic commerce? Will consumers feel comfortable that if their AI agent books an airline flight for them, the dates are correct? Or that the pricing was right? Or that the connections are correct?

Will consumers trust agents to analyze their health information and the lifestyle or supplement recommendations that come from AI?

Will consumers trust their banking information with AI agents if those agents could be hacked like their credit card transactions from retailers?

In my estimation, NO. Consumers are typically willing to trade functional benefits for privacy - think of the social media example above. I will give Facebook my information for ad targeting in order to see those cute photos of my sister's kid. However, AI ratchets up the risk. I honestly believe that as AI becomes more functional, the risk of something going seriously wrong and having a large negative personal impact becomes high. All is needed is one terrible AI hack where a bot cleans out your checking account to destroy any future consumer trust in these developing and emerging platforms.

What does this mean and what can brands and marketers do about it?

So what does this mean going forward and how will we need to rebuild trust to enable future progress and growth of AI? Even though trust is challenged, there’s an opportunity for brands, institutions and technologists to lead with trust as a differentiator — not just speed or novelty.

Here are some strategic levers relevant for marketing, innovation and consumer-centric business to rebuild or strengthen trust:

Be transparent & explain the “how.”

Whether it’s how data is used, how a product is made, or how an AI algorithm works — make visible what it is you do and why.

For tech/AI: Providing explainability, third-party audits, open-source schemas, data-provenance and clear communication reduces perception of the “black-box.”

Embrace authenticity & human-centered signals.

People trust people. Use real voices, real stories, credible third-party testimonials and shift from boilerplate to human-centered narratives.

Even if you use AI or digital tools, emphasize human oversight, human values and accountability.

Engage relationally — not just transactionally.

Trust is built over time via consistency. Don’t just launch a one-off transparency initiative—embed honest communication in your marketing, operations, culture.

Especially when addressing communities historically under-served or distrusted: demonstrate fairness, inclusion, responsiveness.

Align with purpose & shared societal value.

Especially in a low-trust era, brands that show they stand for something (beyond profit) can earn trust premium.

Whether in health & wellness, sustainability or social equity (areas you’re immersed in), aligning brand actions with broader public good helps.

Build for the trust economy in tech.

As AI becomes pervasive, design for trust: provide controls, allow people to opt-in/out, explain AI’s role, disclose AI usage — in short, let users know they’re not blind participants.

Use trust audits, fairness measurement, bias mitigation, transparency dashboards.

Leverage “little wins, big change.”

Trust isn’t rebuilt by big announcements alone—it’s built by a string of small credible actions, consistent over time. As you often say: “little wins, big change.”

Conclusion

Trust isn’t a nice-to-have: it’s foundational. It underpins functioning markets, innovation systems, healthy institutions and collaborative social fabric. Today, we live in a moment of depleted trust—interpersonal, institutional and technological. That creates risk and friction, but also opportunity.

For marketers, innovators and brand leaders — this is a differential moment. Those who build trust intentionally — through transparency, authenticity, human-centred design and consistent purpose-driven action — will win. As emerging technologies like AI shift faster than public understanding, the brands and institutions that build the bridge of trust will occupy a stronger position.

My ask of you: What is one action you will take today to build trust with your audience? What transparency will you provide? What story will you tell? What proof will you show? Because when trust returns, and it will, organizations that have already invested will lead the way.

Is the Marketing Funnel Dead? Or has marketing just gotten more complicated?

I read alot about how the marketing funnel is dead, all marketing is performance marketing, and the world doesn't need brands anymore in an AI world. But somehow we all need to be aware of and find a place to buy the products and brands that make our lives better.

In this short newsletter, we talk about how creators are the new brands and declarations of the marketing funnel being dead are just another way to generate clickbait.

Recently, Fast Company released and article proclaiming the marketing funnel dead - replaced by AI: https://www.fastcompany.com/91410436/the-new-brand-growth-engine-for-the-ai-era

They're not alone. Here on LinkedIN, practically every marketing thought leader is proclaiming the marketing funnel dead. Its easy to see why:

Reinventing or debunking a commonly accepted truth gets eyeballs and clicks

Consumers are truly charting their own purchase paths, which has been evolving rapidly

AI has upset the table that has been set for product discovery since early 2000s

Don't get me wrong. As a Gen Xer, I continue to be amazed at the stuff that I can find online that was not possible. For example, I needed a very specific screw for my new snowboard bindings. I tried local Ski shops, I tried REI. I eventually found the exact screw I needed on Amazon.

However, beyond the clickbait, I honestly believe that the marketing funnel is still one of the best models to overlay intent and action onto marketing activities that we have for a few reasons:

People still need to learn about new stuff somewhere and somehow. Whether its seeing something on TV, in my social feeds or on the highway when I'm driving, traditional and digital advertising are still a good way to expose consumers to new brands and products. This is not meant to drive sales as much as pique interest and drive exploration.

However, we need to look at the channels where our consumers spend their time…and double down there. Podcasts? Twitch? Dischord?

Lastly, content creators are the new brand. Where before, brands worked tirelessly to establish and build on trust with their target, consumers now trust the content creator more than the actual brand. If I follow my favorite creator who recommends a sick pair of adidas, I have a higher likelihood of purchase than if I'm served an ad alone. I'm buying the creator over the brand now.

Open AI and the LLMs are definitely upending the brand growth potential, but they are just becoming a new innovation in a long line of innovations to help connect brands with people who want to buy their products

Why Social Commerce + Affiliate Marketing Are the Growth Engine Cannabis Has Been Waiting For

Cannabis brands don’t have a paid media problem—they have a channel problem.

With advertising restrictions still limiting Meta, Google, and most traditional digital pathways, the real growth engine for cannabis is finally becoming clear:

🔥 Social commerce + affiliate marketing.

Why?

Because cannabis is a trust-first category. People don’t buy because of banner ads—they buy because a budtender, creator, or friend showed them what works.

Here’s the social commerce shift happening now:

* Consumers trust humans, not platforms

* Social content → instant purchase is becoming the new funnel

* Micro-creators with local audiences outperform big national influencers

* Brands only pay on performance (actual sales), not impressions

* Creator storefronts + shoppable links bypass the ad restrictions

And for cannabis companies, the opportunity is huge:

Turn your influencers into revenue partners—not just content vendors. Affiliate models let brands scale locally, authentically, and profitably without ever touching paid ads.

If you’re a cannabis brand looking for real growth:

Start by building an affiliate program, recruiting credible micro-creators (especially budtenders), giving them education + shoppable links, and paying fast. The payoff is enormous.

Social commerce isn’t a trend.

It’s the most scalable, compliant, and culture-aligned growth channel cannabis has ever had.

For most consumer categories, digital marketing runs through a familiar playbook: paid social, search, retargeting, influencers, email, SEO. But cannabis isn’t most categories. Even in 2025, brands still face some of the toughest advertising restrictions of any consumer industry.

Yet one of the biggest opportunities for cannabis companies is finally breaking open: social commerce and affiliate marketing. These models thrive in categories where trust, community, and word-of-mouth shape purchase behavior—which makes them almost perfectly suited to cannabis.

Here’s why they work, how they differ from traditional e-commerce, and how cannabis brands can start using them today.

Why Social Commerce Works in Cannabis

Consumers trust people—not platforms

Cannabis is a category where product literacy is still developing. The average consumer doesn’t fully understand strain genetics, terpene profiles, extraction methods, or formats—and they don’t want a lecture. They want a trusted human to guide them. When I was at Planet 13, we prepared for massive crowds on 4/20 and established an "express line" with limited items for those customers who knew exactly what they wanted. Surprisingly, even when encouraged to "skip the line" most consumers preferred to talk to a budtender, ask questions and generally have a more interactive experience.

Budtenders, micro-influencers, and educators already act as this “trust layer.”

Social commerce lets brands turn that trust directly into sales.

It bypasses the advertising restrictions (legally and organically)

Social platforms limit most paid cannabis advertising, but they do not block:

Product experiences

Education

Reviews

Ritual and lifestyle content

Personality-driven storytelling

When that content connects to a shoppable link, affiliate code, or creator storefront, discovery and purchase happen in one flow—no paid media required. The key, though is to move BEYOND just influencers promoting a dispensary or brand and move past to recommending products for purchase

The category is inherently social and the products keep evolving

From first-timers to enthusiasts, cannabis has always been a people-driven category and the nature of the product - with its different formats and strains - makes it perfect for sharing and conversation. Sharing recommendations is part of the culture. Just when you think you've tried everything, some unique brand or cultivator has dropped a product that you've never heard of before. Even if you're not a newbie, at some point you need to figure out the difference between Rosin and Resin, the difference between a joint and a spliff. Social commerce simply amplifies a behavior for sharing personally that already exists.

Why Affiliate Marketing is a Natural Fit

Affiliate Marketing is Performance-based, not friction-based

Traditional marketing models require significant upfront spend—impressions, clicks, and content fees—with no guarantee of revenue. In every cannabis role I've worked on, marketing spending has been an afterthought at best and non-existant at worst. All of the startup money goes into operations with little left around true digital marketing or brand building. It doesn't help that most cannabis companies - even the most well known brands - are severely undercapitalized vs. their CPG comparisons. Affiliate marketing is the opposite of these traditional paid models: brands pay only when a verified sale happens.

In a category with tight margins and fragmented regulations, this model is far more efficient.

Influencers become true business partners

Instead of one-off posts, creators can earn ongoing income through the sales they drive. That changes the relationship from “content-for-pay” to “revenue-sharing partnership”—attracting more committed, motivated ambassadors.

Local creators matter more here than anywhere else

Cannabis is a state-by-state, city by city business. A creator with 8,000 Colorado followers can drive more real sales than a creator with 800,000 national fans. Affiliate models empower hyper-local influence—one of the industry’s strongest levers.

How Cannabis Brands Can Grow Through Social Commerce

1) Build the Foundation

Use a compliant affiliate platform (Refersion, Awin, Impact).

Create unique links, shoppable landing pages, and discount codes.

Create standard asset that influencers can use - logos, images, videos, etc. Make it easy for your affiliates to stay on-brand

2) Recruit the Right Influencers

This is the tricky part. There are lots of people who want to get paid to recommend cannabis products, but it's important to prioritize credibility over follower count. Why? Follower counts are likely 30% fake. Also, if people trust your influencers, that will more likely convert to customers:

Budtenders and dispensary staff

Cannabis educators and reviewers

Micro-influencers (5k–50k) with local audiences

Lifestyle creators who authentically use your products

These are your high-converting storytellers.

3. Give Influencers “Story Kits”

Provide:

Short, recommended or approved talking points

Education on effects, formats, and rituals

Do’s and don’ts for compliance

Brand photography, UGC examples, and video prompts

You’re not giving them scripts or trying to tell them what to say; you’re giving fuel for storytelling

4. Build Social-Native Storefronts

Examples include:

TikTok Shops (where legally possible)

Instagram Collabs

Link-in-bio retail landing pages

Creator-branded “pick lists”

Make it incredibly easy for consumers to buy at the moment of inspiration.

5. Integrate With Retail Partners

This is key. Since most cannabis sales ultimately happen at the dispensary, its critical that the dispensary knows where the traffic came from and will compensate for the sale. This is the best use of their marketing budget

Tie each affiliate link to the correct local menu

Give creators store-specific links

Offer retailer incentives for pushing creator-driven traffic

This turns social traffic into real in-store revenue.

6. Pay Fast and Track Performance

Creators stick around when they get paid quickly.

Monitor:

Sales by creator

Content engagement vs. conversion

ROAS compared to other acquisition channels

In cannabis, affiliates often outperform paid search by 3–5x.

7. Turn Top Performers Into Pro Partners

Elevate your best influencers into:

Ambassadors

Retail event hosts

Brand educators

Co-branded product collaborators

Recurring content creators

Scaling your stars is one of the fastest ways to grow.

Social Commerce Isn’t a Trend—It’s Cannabis’ Most Scalable Growth Channel

Cannabis brands need channels that:

Circumvent paid media restrictions

Build trust and education

Scale locally, not nationally

Deliver predictable ROI

Align with culture and behavior

This is a new way of thinking about and orienting your cannabis marketing mix. Sure, sampling, demos, in-store events are necessary, but affiliate models are the most industry-right way of driving measurable sales in an industry where people matter.

The brands that activate creators—not algorithms—will be the ones that win the next decade of cannabis marketing.

To talk more about marketing in the cannabis industry, let’s grab time together!

Potato Chips, Artificials, and MAHA: Politics Indeed Creates Strange Bedfellows!

It was just announced that Lay’s is taking out artificial flavors and colors out of their products. How did our food supply become so ultra processed in the first place? And why is it still so hard for food companies to change? In this blog, I talk about my personal experience working in and with Fortune 50 food companies on innovation and why its so hard for them to unravel their ultra processed pasts.

I recently read in the news that Lays was removing all of their artificial colors and flavors by end of 2025. Having worked at PepsiCo and other CPG companies for most of my career, this was an interesting development and welcome surprise. However, I'm probably not the first to say "there are artificial colors and flavors in potato chips??"

How did we get here and what does the future look like for CPG food manufacturers?

Much of our food supply we have taken for granted in 2025. Many of us have learned that there are two main sections of the store - 1) the Perimeter: where fresh vegetables, dairy, and bakery live and 2) the center - aisles filled with pre-packaged, canned, bottled, or frozen items. Countless health and wellness thought leaders have given the advice to shop the perimeter and skip the center to avoid artificials, preservatives, and ultra processed foods. Indeed some estimates put the American diet composed of 70-80% ultra processed foods. We're still coming to terms with the long term health impacts of ultra processed foods, but the journey of how we got here remains long.

Early last century, food safety wasn't a throwaway issue. As detailed in Upton Sinclair's The Jungle unsanitary meatpacking practices were dangerous and created an outcry which laid the foundation for the Food and Drug Administration, as well as pasteurization and canning. However it was WWII that really accelerated advances in food preservation - freezing technologies, dehydration, irradiation, and vacuum-packing for shelf stable foods. For the time this was a breakthrough - food could be preserved much longer and it set the stage for massive CPG food companies to operate.

Once large CPG companies started to industrialize food production, corporations did what they do best - find ways to extract cost out of the process via processing ingredient. Ingredient were processed to make them more uniform and predictable for manufacturing. Real flavors were variable in consistency so they were swapped out for the predictable, processed ones.

While working in innovation at PepsiCo I saw this first-hand. I was paired up with a talented entrepreneur to create an all natural, organic Overnight Oats product. This entrepreneur had a recipe that he had developed in his kitchen combining organic dried fruits and spices to create some really delicious breakfast options - just add milk! The challenge came when we tried to recreate the recipes for scaled manufacturing within the PepsiCo system. PepsiCo had optimized it ingredients and suppliers over decades - carefully selecting suppliers based on the consistency of their products and how well it worked within the PepsiCo system. And it worked just great…for what they were already producing. However for this new Overnight Oats product, the ingredients were not in the PepsiCo system. Where the recipe called for organic cherries, the supplier network only had non-organic cherries that were coated in dextrose (a sugar) for easier processing. Using that ingredient would not work for us, but when we tried to get a new supplier approved who actually sold the ingredient we were looking for, the PepsiCo vetting process for a new ingredient would take about 12 months.

The problem was that starting in the 1970s with the establishment of the organic food movement to early 2000s, consumers became much more savvy about where their food came from and started to prioritize Organic and local farming, GMO free, and eventually farm-to-fork traceability. Consumers wanted MORE information about where their food came from, how it was grown, and how it was processed. In recent years, that trend has continued with the emerging awareness of the health issues of ultraprocessed foods. As a result CPG food manufacturers have found themselves heavily invested in ingredient sourcing and processing that is becoming more and more irrelevant from a consumer standpoint. Their solution in the face of these trends has been to make token changes - maybe have an organic variety of cookie (which is more expensive) alongside the standard variety (which is less expensive). Meanwhile their loyal consumer base starts to erode and shrink. The corporation feels like it has done its best to address consumer trends while maintaining the status quo and their profits. Never has consumer health and wellness entered the conversation.

So here's where it gets a bit weird. Now the MAHA movement spearheaded by Robert Kennedy Jr. has put artificials, sugar, and ultraprocessing in the crosshairs of the US government. Suddenly we're seeing companies independently getting ahead of any future regulation by "cleaning up" their ingredient lists and moving away from processing. As a Health and Wellness enthusiast, I'm really torn. I love the focus on cleaning up ingredient lists - it really puts CPG companies more in step with consumer preferences and inches the US toward a healthier food system. On the other hand there are a number of additional policies that the MAHA team is pursuing which (in my opinion) do not further our country's health and wellness

So for the moment, I love seeing the headlines of large food companies making well-needed changes to de-industrialize the food we eat on a daily basis - even if it means that we have an increase of suspect advice around things like vaccines, Tylenol, etc.

What do you think? Is the improvement in our food system worth the increase of conspiracy theories? Let me know your thoughts!!

-Bryant

Here's the original article about the changes to Lay's

Everyone wants speed. few know how to enable it

Discover how organizations can move faster by embracing risk tolerance, fostering a culture of YES, navigating regulations, leveraging scale, and using AI to reduce friction. Learn practical strategies to accelerate execution and innovation

As a marketing leader, you’re incentivized on results - the faster the results come, the better. However, speed is easier said than done.

Speed for creation: How can you launch products or content faster?

Speed for execution: How do you move from idea to launch in weeks, not months?

Speed for advantage: How can you react to competitors in real time?

As I speak to colleagues and mentors in the @cpg, @food and beverage and @wellness space, once we get through talking about AI, one topic eventually comes up: speed.

Speed for creation - how can we get that new product launched faster, how can we get that video created sooner. Speed for execution: How can we get from idea to execution faster? How can a 12 week project get executed in 4 weeks? Speed for competitive advantage: How can we react quickly to movements in the market by competitors?

As a marketer who has worked across industries - from beauty to wellness to CPG to food and beverage - this is a common theme. More, better, faster. However when I've sat down with partners and clients to unpack what are the barriers to speed, very few marketers feel that they are equipped to skip over the barriers and roadblocks that are placed in their way to enable speed. Everyone wants speed, but so few know how to enable it within their organization.

What are the enablers to speed? From working in Fortune 50 to startups, agency side to client side, here are my observations on the barriers to speed and ways to enable speed in your business.

Risk Tolerance. This is by far the biggest barrier to speed and probably the top reason that Fortune 50 companies are perceived to be slow. The internal tolerance for risk (or lack thereof) drives for certainty in execution and low tolerance of failure. To be more certain, you need to do your testing and learning behind closed doors before it's released to the world. The core rationale is that the marketing investment to launch is high, so certainty needs to be high as well. The dirty secret is that many products that test well internally fail in the market. Startups, who lack the resources to do extensive internal testing, have a higher tolerance for risk and as a result are naturally faster to market. So what do you do about this? Get your organization comfortable with the risk. Highlight the opportunity cost of not taking the risk. Create a "burning platform" internally which focuses on action over risk.

A culture of NO vs. a culture of YES. Like you, I have been in organizations that have been cultures of NO. Whatever great idea people come up with, the default attitude is "prove it to me" and the default answer is NO. Many middle managers feel like their doing their job by asking searing, penetrating questions the answers to which their team may not have. So the team goes back to work, addressing the questions and adding weeks onto the process. In an organization where there is a culture of YES, managers prioritize action over perfection. That doesn't mean these managers don't ask questions. However the questions are less "prove it to me" and more "keep going, but consider this as well". Its amazing to work within an organization with a "culture of yes". You see rank and file employees who are always curious -- taking initiative and ownership knowing their management will support them. Conversely in an organization with a culture of NO, you have employees that punch the clock. You only need to get shut down a couple of times to realize that its just easier to do the obvious and easy things.

Understand the rules before you begin - This is particularly important in highly regulated categories, but it is also key for any business looking to move quickly. Doing your homework to understand where the legal and regulatory guardrails allows you to create a MVP that at the very least won't get shut down by internal legal or the FDA when you're looking to scale. There are times to challenge convention and intentionally break rules that need to be broken to drive disruption in the market. However, to enable speed, it helps to know where the potholes are before the race begins

Make scale work for you, not against you - When I was working with the business school professor and entrepreneur Barry Nalebuff on an overnight oats project at PepsiCo, we quickly ran into the dark side of scale. While we were looking for organic blackberries, the procurement team was telling us there were not enough blackberries in the world to supply our initiative. What? What the procurement person meant is that they didn't have a preferred supplier of organic blackberries and to validate a new supplier would take about a year. A great example of scale working against you. However, what if because of your scale you can talk to partners that smaller companies would only dream of partnering with? At PepsiCo, I was guaranteed to be able to get a meeting with just about anybody - partners like Fair Trade USA, media organizations, NGOs were all eager to talk with us because of the scale we represented. No matter your size, you are always bigger than someone else and can link up to drive programs faster.

Technology reduces friction and gets you a head start - So much ink has been spilt around AI that I hesitate to add it to this discussion but no discussion around speed is complete without talking about how AI and emerging technology can help businesses to move quickly. AI technology can turn a competitive assessment around in seconds not days. AI can scrape Tik Tok and within seconds tell you the top trends in your category. However, many believe the starting point is the finish line. Using AI to scrape trends is not the answer - why? Because your competitors are doing the same thing. AI output is a starting point to inspire, generate ideas and highlight potential vectors that may not have been considered at the outset. It's up to the human in the machine to assess output and generate new ideas or new directions that are novel to the business. Thinking about #2 in the above list (a culture of NO) AI output can help you to structure your business case, and ideally lend you credibility and get you further down the development path than brainpower alone.

In conclusion, for as many companies are advocating and incenting speed, without a considered examination of their current decision structure, they will forever be frustrated with how long things take to get executed. Remove barriers. Change your approach. Get comfortable with risk. There is no free lunch to enable speed in your organization.

The Existential Risk Of Losing Your Way: Whole Foods Considers Selling Mass Brands

Whole Foods is thinking about selling Doritos now.

Let that sink in.

For a brand built on “wholesome, natural, curated,” this move feels... off. Sure, it’s a smart revenue grab — but at what cost?

When a brand built on trust and values starts chasing short-term sales, it risks eroding the very thing that made it successful in the first place.

Whole Foods was the anti-Kroger. Now, it’s inching closer to being just another aisle.

Mission drift is real. And once you lose the consumer who believed in your promise, no amount of Doritos will fill that basket

Stop me if you've heard this one before. You're making your weekly grocery list and you get to the point where you decide which store to visit. You look at the items on the list - fruit, vegetables, meat, snacks. I'm not convinced of the quality of fruit, veggies and meat at my local store so Whole Foods looks like the obvious choice. But wait. What about snacks. Not just any snack, though - Triscuits. They're healthy-ish and I like a good Triscuit with cheese. However, I've tried the Whole Foods version of this cracker type and it's…meh.

So what do I do? Do I scrap my trip to Whole Foods to ensure that I can get my Triscuits at the local grocery store? Do I make a second trip AFTER Whole Foods? Or do I just forget about the Triscuits for now and pick them up during a fill trip at my local store in the middle of the week.

Honestly, I do all three - just depends on how much I'm craving Triscuits. Apparently, Whole Foods has been doing some consumer research on people like me - people who want the promise of eating healthy, without Ultra-Processed Foods - but who also have some Ultra-Processed habits like Triscuits. It makes sense to think about capturing that one extra purchase from that consumer. They're already in your store, just capture that one more product.

For most retailers, I would say that this is a tried and true strategy - getting current consumers to buy more. Capturing more of their "share of requirements" - which means if consumer spend 50% of their money at one retailer like Whole Foods, how can I get them to spend 51% of their money at Whole Foods. It is a classic revenue growth tactic for brands and retailers.

There is another revenue growth tactic that Whole Foods has been leveraging for years - basket building and upselling. For consumers coming into your store, how do you get them to buy that delicious apple pie in addition to their staples. How can they get you to buy the premium ice cream instead of the value ice cream. This has been successful for Whole Foods for one core reason - they understand their consumers. They know that their consumers are looking to snack and indulge like everyone else - but in a less processed, healthier way. And they also know that their consumers are distrustful of the large multi-national food companies and shun which is why they don't stock their products. This has given rise to a startup-friendly environment where Whole Foods delights its consumers by bringing in brands that are high on authenticity & story and low on GMOs & UPFs. The result is Justin's not Jiffy. Poppi not Pepsi.

So that's why today's article in the Wall Street Journal is so perplexing: https://www.wsj.com/business/retail/whole-foods-brand-identity-amazon-9953d8a0?st=2xWHdq&reflink=desktopwebshare_permalink

The upshot is that Whole Foods is trialing a way to sell multi-national food companies' product - in either a "hidden" way (ShopBots fetching your Doritos from the back) or in a "store in store" kind of way - keeping the Doritos in a dedicated section of the store away from the other snacks.

I'll pause here for effect. Pay attention to what's going through your mind right now. Likely that feeling is cognitive dissonance which goes something like, "Wait, doesn't Whole Foods have a mission to sell wholesome, natural foods? Aren't they my food curator, making sure that anything I buy has a stamp of that mission? So, how can they sell Doritos which seems to be the exact opposite of wholesome and natural - and can barely be registered as food."

This is a classic case of a brand or business departing from the mission and values which brought them success to chase new revenue streams or growth. It may seem like I'm a brand purist, pearl clutching at the very practical moves of a business which needs to deliver growth, but I don't see it that way. With a move like this Whole Foods risks:

Losing their relevance in the value proposition: If Whole Foods is closer to Kroger, it means that shoppers who are looking for their curated selection of naturally vetted products lose trust that Whole Foods can deliver on that mission rather than chasing increased sales

Opening up their core point of difference to competitors: Sprouts, Natural Market are just salivating to claim the crown of natural/organic retailers from Whole Foods. This move opens up a crack to competitors to de-position Whole Foods as just another pawn of Amazon

Lastly, it should be noted that a move like this also ignores their consumer. The wellness and natural foods consumer has left mass brands and retailers for a reason, and the distrust of large mechanized food is real. For their core consumer, this is akin to "selling out" their original mission. Once you've lost the consumer who has brought you success then you erode the very foundation of your brand and revenue stream.